北航经商院 • 经济学双周论坛 第五期

尊敬的各位老师:

你们好!

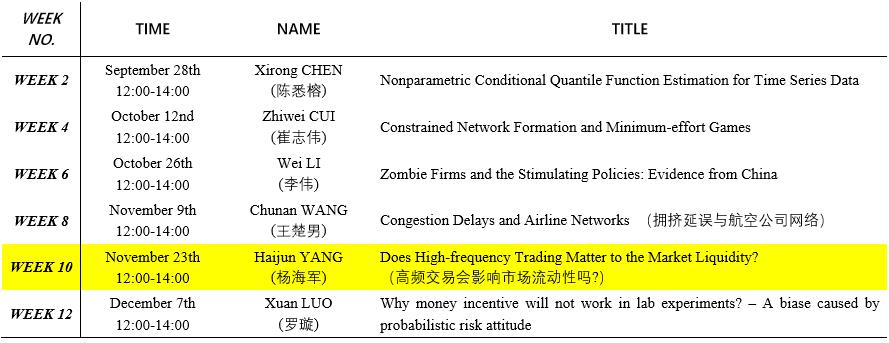

为促进学院经济学学科发展,经济与商学研究院于2017年9月正式启动“北航经商院 • 经济学双周论坛”学术讨论活动,论坛第五期讨论将于本周四(11月23日)中午12:00-14:00举行,地点在新主楼A949。

在此诚挚邀请您参与讨论,对学院青年老师的科研工作斧正指导。

论坛具体日程安排如下:

题目: 高频交易会影响市场流动性吗?

Title: Does high-frequency trading matter to the market liquidity?

主讲人: 杨海军

Presenter: Haijun YANG

摘要 (Abstract):

论文构建了包含高频交易者的模型以研究市场流动性,其中高频交易者具有信息优势得到有关证券的真实价值,并利用他的速度优势来优化报价策略模型引入了包含资产交易量和波动性的信息成本函数。我们得到了高频交易做市者的最优报价策略和稳定的报价价差。我们假设低频交易者提交的订单和新闻事件的发生服从泊松分布。因此, 高频交易者可以在一个周期内完成双边报价。研究表明,更多的低频交易者和更高的延迟会损害市场流动性。存在大量低频交易者的情况下,高频交易者会使用双边报价。在高波动情况下, 高频交易者会采用单边报价。最后,我们使用NASDAQ的数据验证了模型的结论。

We propose a model including a high-frequency trader (HFT) who has an informational advantage, receives information about the true value of a security and exploits his speed advantage to optimize his quoting price. A novel information cost function is introduced including the volatility and volume of the asset. Then, we characterize the optimal bid-ask price strategies and obtain the stable bid-ask spread. We assume that orders submitted by low frequency traders (LTFs) and news events arrive at market with passion processes. Thus, the bilateral quotation of HFT can be traded in one period. We find that more LTFs and higher exchange latency both hurt market liquidity. In addition, the HFT is willing to quote at two-side for a large number of LTFs. However, the HFT chooses a one-side quotation cautiously for high volatility. Furthermore, we empirically provide evidences for our model’s predictions by a sample of NASDAQ trades and quotes.

主讲人简介 (Introduction):

杨海军教授现任9999js金沙老品牌教授、博士生导师、Fulbright学者,专注于计算金融、行为金融及理论经济学建模相关领域;曾获得教育部自然科学奖一等奖,并承担负责参与多个国家自然科学基金项目,在国内外著名期刊发表20多篇学术论文。

Hai-Jun Yang is a professor of the School of Economics & Management, Beihang University, Fulbright Scholar. His primary research interests include computational finance, behavior finance and economical modeling. His research has been funded by several National Natural Science Foundation of China grants. He has authored more than 30 papers, one books, and several book chapters. He also got the first prize of natural science of Ministry of Education of China.

* 具体详情,也可扫描下方微信二维码:

经济与商学研究院

2017年11月17日